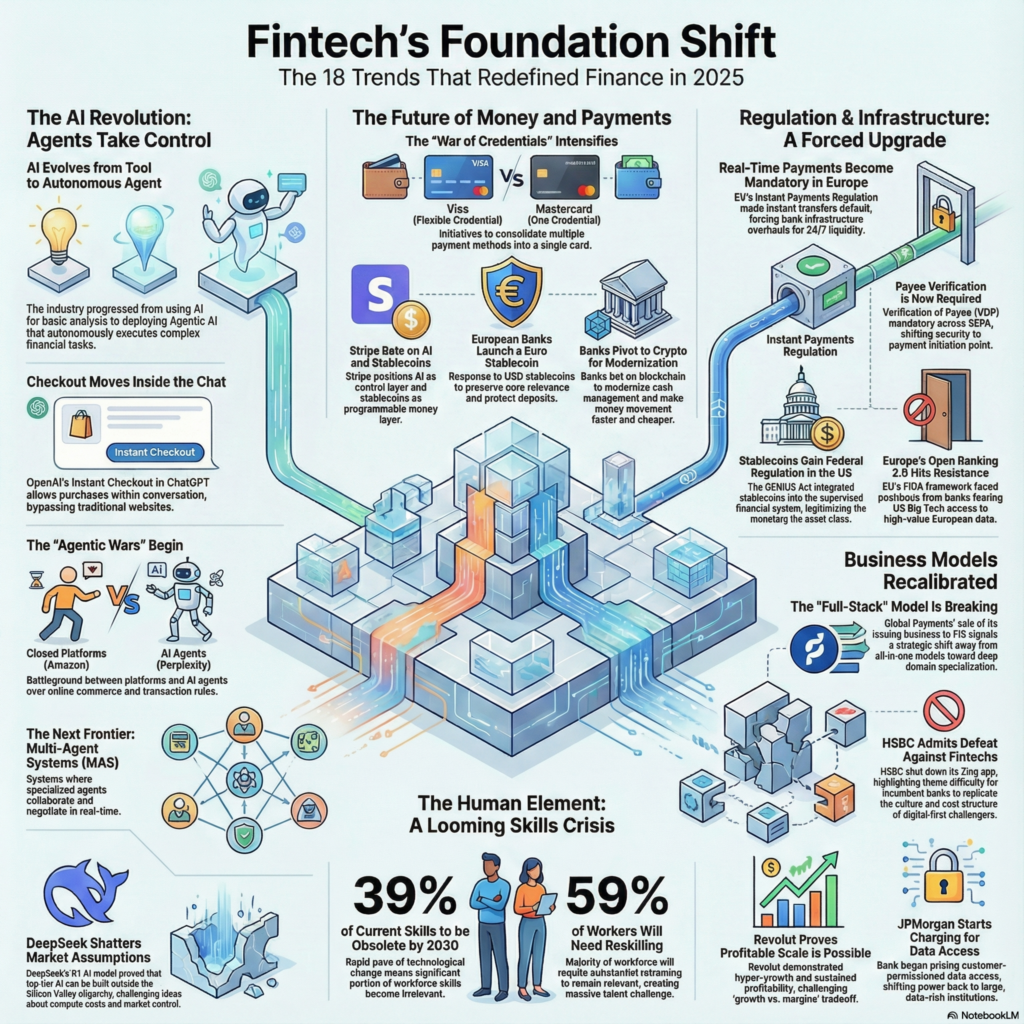

The 2025 Fintech Retrospective: 18 Trends That Redefined the Industry

As we close the book on 2025, the question isn’t just “what happened,” but “what actually changed the game?” It has been a year of radical shifts—from the rise of autonomous AI agents to the regulatory enforcement of real-time everything.

We saw incumbents stumble, challengers solidify their dominance, and the very nature of a “transaction” move from human hands to machine negotiation. Based on the defining moments of the last 12 months, here is my shortlist of what shaped fintech in 2025.

I. The AI Revolution: Agents Take the Wheel

If 2023 was about Generative AI, 2025 was the year of Agentic AI. The technology moved from merely generating text to executing complex financial tasks autonomously, sparking new wars for control.

- DeepSeek Shocks the Market: The release of DeepSeek’s R1 model shattered the assumption that US tech giants had an unassailable moat on compute and pricing. It proved that competitive, high-power AI models could emerge from anywhere, challenging the established AI hierarchy.

- The Rise of Agentic Commerce: We saw the battle for payment credentials move upstream. With PayPal, Mastercard, and Visa all vying for dominance in Agentic AI, the goal is no longer just processing the payment, but being the preferred wallet for the AI agent making the purchase.

- Checkout inside the Chat: OpenAI launched Instant Checkout in ChatGPT, fundamentally changing the user journey. Commerce no longer requires a website visit; it happens entirely within the conversation interface.

- The “Agentic Wars” Begin: This shift hasn’t been peaceful. Amazon’s lawsuit against Perplexity signaled a major clash. It is a fight between closed platforms trying to defend their walls and emerging AI agents that want to traverse the web freely to execute commerce.

- Multi-Agent Systems (MAS): We moved beyond single bots to Multi-Agent Systems. Specialized agents now negotiate and adapt in real-time, handling complex value chains without human intervention.

- Stripe’s Double Bet: Stripe positioned itself as the control layer for this new world, betting heavily on AI as the infrastructure and stablecoins as the programmable money that these agents will use.

II. Regulation & Infrastructure: Real-Time is the New Baseline

In Europe and the US, regulators stopped asking nicely and started mandating updates, forcing a massive overhaul of legacy infrastructure.

- Instant Payments Go Live: The Instant Payments Regulation finally went live in Europe. Real-time is now the default, not a premium feature, forcing banks and PSPs to urgently upgrade their tech stacks to handle 24/7 liquidity and settlement.

- Verification of Payee (VOP): Hand-in-hand with instant payments came mandatory Verification of Payee (VOP) across SEPA. Fraud prevention has shifted to the initiation of the payment, making identity verification a core control layer.

- FiDA Pushback: It wasn’t all smooth sailing. FiDA (Europe’s Open Banking Framework) faced significant headwinds as EU banks pushed back, fearing the regulation would inadvertently hand over high-value financial data to US Big Tech firms.

- The GENIUS Act: In the US, the GENIUS Act brought stablecoins into the supervised financial infrastructure. This was a watershed moment, integrating crypto rails into the banking system to reinforce US monetary influence.

III. Strategy & Consolidation: The End of “Full-Stack”

The “super app” dream took some hits, while specialization and profitability became the new north stars.

- The Fall of Zing: HSBC closed its Zing app, admitting defeat in its attempt to compete directly with Revolut and Wise on FX. It highlighted the difficulty incumbents face when trying to replicate agile fintech models internally.

- Global Payments & Worldpay: In a massive industry shift, Global Payments bought Worldpay but sold its issuing business to FIS. This signals a move away from “full-stack” models toward deep domain specialization—scale alone is no longer the ultimate advantage.

- Revolut’s Profitability: On the flip side, Revolut posted impressive 2024 results, proving that sustained profitability at a global scale is possible. They successfully challenged the old assumption that you can have fintech growth or bank margins, but not both.

- JPMorgan Monetizes Data: JPMorgan shifted the power dynamic by putting a price tag on customer-permissioned data. This challenges the economics of Open Banking, signaling a return of bargaining power to the large data holders (the banks).

IV. The Future of Money: Credentials & Crypto

The definition of “money” and “cards” continued to blur as banks and networks tried to keep up with digital demands.

- The War of Credentials: Visa (VFC) and Mastercard (MOC) launched initiatives to reinvent the card. By consolidating multiple payment methods into a single credential, they are trying to save the plastic card from obsolescence in a digital wallet world.

- EU Banks Fight Back with Stablecoins: In a strategic response to USD dominance, EU banks launched a Euro Stablecoin. This is a defensive play to preserve deposits and payment flows within the European banking ecosystem.

- Banks’ Crypto Pivot: Perhaps the biggest irony of 2025: Banks that were long skeptical of crypto are now betting on it to modernize their cash offerings, admitting that blockchain rails offer efficiencies legacy systems cannot match.

V. The Human Element

Finally, we cannot ignore the human cost of these rapid technological advancements.

- The Reskilling Crisis: The future of work arrived faster than expected. Data now suggests 39% of current skill sets will be obsolete by 2030, with 59% of workers requiring reskilling. As AI agents take over operations and payments, the human workforce must adapt or risk irrelevance.

What All This Means

2025 wasn’t about one breakthrough. It was about structural realignment. Real-time payments became default infrastructure. AI moved from experiment to control layer. Stablecoins got regulatory legitimacy. Card networks started defending their turf. Banks began splitting their businesses and pricing their data.

The common thread is that fintech is maturing. The easy growth is over. The rules are being rewritten. The winners in 2026 won’t be the ones with the best pitch decks. They’ll be the ones who understood which of these shifts actually mattered and moved accordingly.

References

I. The AI Revolution & Agentic Wars

- DeepSeek’s Market Impact: Three Takeaways from the DeepSeek R1 Release

- Amazon vs. Perplexity Lawsuit: Amazon vs. Perplexity: A Lawsuit Over AI Agents that Shop

- The Rise of Agentic Commerce: Amazon takes legal action against perplexity over AI tool

II. Regulation & Infrastructure

- Instant Payments Deadlines (SEPA): Meet the SEPA Instant Payments deadlines with our checklist

- 2025 SEPA Rulebook Updates: EPC 2025 SEPA Rulebook Updates

- FiDA (Financial Data Access) Status: Financial Data Access (FiDA) Regulation Overview

- Visa Flexible Credential (VFC): Visa Flexible Credential Product Page

III. Strategy & Consolidation

- HSBC Zing Closure: Zing travel money app to shut down – what you need to do

- HSBC Zing Analysis: Venture Lessons from HSBC Zing

- Global Payments & Worldpay Merger: Global Payments to Acquire Worldpay in Three-Way Deal

- Merger Details: Global Payments to acquire Worldpay from GTCR and FIS

IV. The Future of Money

- Stripe & Stablecoins: What Stripe’s Acquisition of Bridge Means for Fintech and Stablecoins

- DeepSeek & AI Shifts: What Follows Deepseek | The Kyndryl Institute

Amazon Sues Perplexity to Stop Its AI Tool From Helping Shoppers

This video from Bloomberg Technology provides essential context on the “Agentic Wars” (Point 17), detailing the specific legal arguments Amazon used against Perplexity regarding autonomous AI shopping agents.