Introduction

In the ever-evolving landscape of finance, where every decision carries weight and every data point holds potential, the fusion of artificial intelligence and market expertise has ushered in a new era of possibility. As an expert deeply immersed in the convergence of financial services and cutting-edge AI, I am thrilled to introduce you to a groundbreaking journey that traverses from text to trades, where the realms of language and finance unite through the remarkable capabilities of FinGPT and LLAMA 2.

Picture this: a vast sea of financial data, an intricate tapestry of news, market reports, and economic insights that constantly shape the trajectories of markets and investments. In such a dynamic environment, extracting actionable intelligence from this flood of information is akin to finding a needle in a digital haystack. This is precisely where the revolutionary power of language models steps in, transforming the way financial decisions are made.

With FinGPT and LLAMA 2, we’re not merely dealing with ordinary algorithms; we’re engaging with artificial intelligence systems that possess the innate ability to understand the nuances of human language and decipher the intricacies of market trends. These language models aren’t confined to programmed responses; they are explorers, learning from the vast body of financial literature, market history, and real-time updates to generate insights that can guide investment strategies, risk assessments, and decision-making with unparalleled precision.

Imagine being able to effortlessly generate detailed, market-savvy reports that capture the essence of a complex financial landscape. These models have the prowess to assimilate mountains of data and synthesize them into easily digestible summaries that can shape investment choices. The traditional barriers of data overload and time-consuming research dissolve, allowing financial professionals to channel their energy into higher-level analyses and strategic planning.

But the prowess of FinGPT and LLAMA 2 isn’t limited to generating summaries alone. They’re conversation partners that grasp context, engage in dialogues, and provide real-time insights. They transform into advisors that highlight potential risks, suggest diversification strategies, and adapt to market fluctuations, all while speaking the language of finance with a fluency that’s both impressive and impactful.

What’s truly awe-inspiring is how these AI frameworks embody the very essence of learning. Just as seasoned traders evolve through years of market exposure, these models learn and adapt over time. They comprehend the ebb and flow of sentiment, identify patterns that elude human observation, and offer perspectives that open new doors to success. They’re not just algorithms; they’re partners in innovation, constantly refining their skills as the markets evolve.

In this article, we will delve deeper into the mechanics of FinGPT and LLAMA 2. We will explore their applications in risk assessment, portfolio management, customer communication, and even the intricate world of algorithmic trading. With each installment, we’ll uncover the ways in which these AI marvels are redefining the financial landscape, empowering professionals and investors alike with insights that transcend the boundaries of conventional wisdom.

So, join me in this exploration — a journey that bridges the realms of language and finance, where algorithms think like investors and information becomes action. Together, let’s witness how FinGPT and LLAMA 2 are not just shaping financial decision-making but are propelling it into a future where innovation knows no bounds.

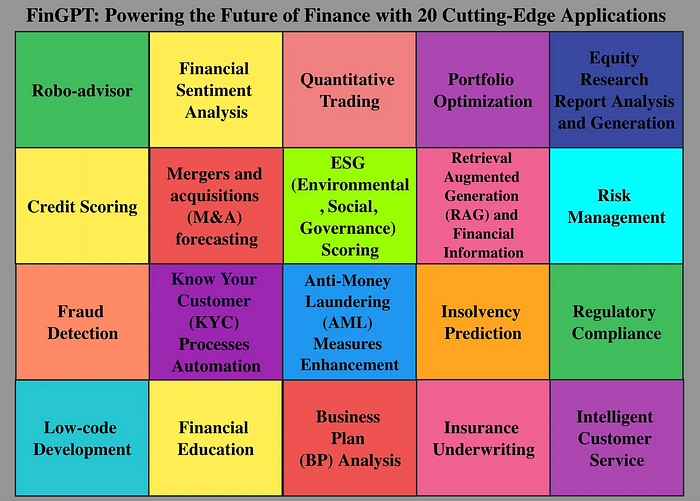

1. Understanding FinGPT and LLAMA 2: Revolutionizing Financial Intelligence

The financial landscape is a complex ecosystem where data-driven decisions can mean the difference between success and failure. In recent years, the integration of artificial intelligence (AI) and advanced language models has brought about a paradigm shift in the way professionals approach financial analysis and decision-making. At the forefront of this transformation are two remarkable technologies: FinGPT and LLAMA 2.

The Rise of AI in Finance: A New Era of Data-Driven Decision-Making

Historically, financial decision-making was heavily reliant on human expertise, manual analysis, and data interpretation. However, the explosion of data availability, combined with the rapid advancements in AI, has paved the way for a new era. AI technologies are not only capable of processing massive volumes of data at unparalleled speeds but also possess the ability to uncover hidden patterns and insights that may elude human analysts. This fusion of computational power and analytical precision is changing the very fabric of financial services.

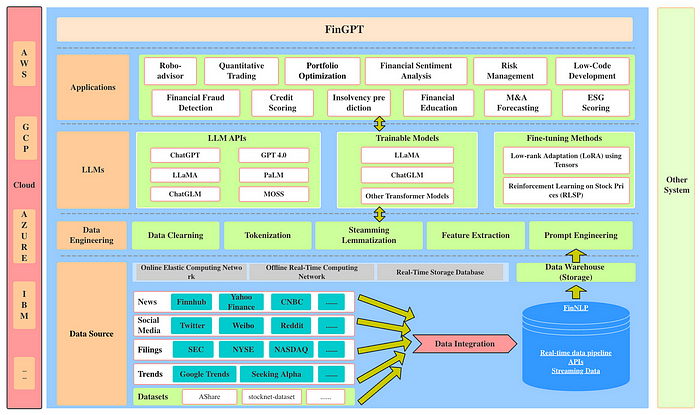

Introducing FinGPT and LLAMA 2: Powerhouses of Textual Understanding

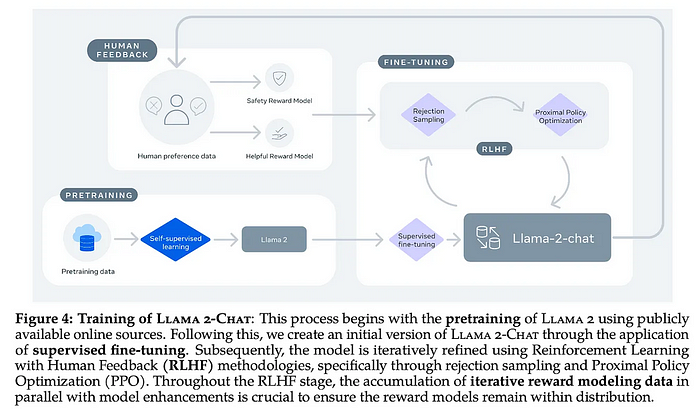

At the heart of this transformation are FinGPT and LLAMA 2, two cutting-edge AI models designed to understand and generate human-like text. FinGPT is an iteration of the renowned GPT (Generative Pre-trained Transformer) architecture, fine-tuned specifically for financial contexts. LLAMA 2, on the other hand, stands for “Language Model for Financial Applications,” and it’s built upon the foundation of GPT-3, tailored to address the intricate language nuances of the financial domain.

FinGPT is a specialized AI language model, a sibling of the renowned GPT-3, but trained specifically to excel in the world of finance. It possesses a profound understanding of financial jargon, market dynamics, and economic trends. FinGPT can swiftly analyze vast datasets, generate reports, and provide insights that empower financial professionals in their daily tasks.

LLAMA 2, on the other hand, is another formidable player. It stands for “Latent Linear Market Analysis” and is designed to decode the wisdom embedded in financial markets. LLAMA 2 takes a deep dive into market data, uncovering hidden patterns and relationships that human analysts might overlook. It’s a powerful tool for quantitative analysis and risk assessment, serving as a virtual ally in portfolio management and algorithmic trading.

But what sets these AI models apart is their proficiency in understanding text. They can digest and interpret textual data from financial news, earnings reports, regulatory filings, and market commentaries. They can grasp not just the data itself but also the context, sentiment, and potential impact on financial instruments. This textual intelligence is a game-changer, allowing for real-time sentiment analysis, regulatory compliance, and personalized customer interactions.

In the financial industry, where seconds matter and insights translate to gains or losses, FinGPT and LLAMA 2 offer a competitive edge. They can predict market shifts, optimize portfolios, and even enhance customer communication. Yet, they are not infallible; understanding their capabilities and limitations is crucial.

Both models possess an incredible aptitude for comprehending the context, semantics, and complexities of financial language. They can interpret market reports, financial news, regulatory documents, and other textual data sources with remarkable accuracy. This capability to ingest, understand, and derive insights from vast amounts of textual information enables professionals to bypass the time-consuming task of manually parsing through documents. Instead, these models surface key takeaways, trends, and critical information that directly impact financial decisions.

How AI Meets Financial Expertise: A Synergistic Partnership

The power of FinGPT and LLAMA 2 lies not only in their ability to process data but also in their capacity to emulate the expertise of seasoned financial professionals. These models “learn” from the collective wisdom present in the myriad of financial documents they’ve been trained on. This learning process equips them with an understanding of market dynamics, economic indicators, and industry jargon, allowing them to provide insights that reflect the acumen of experienced analysts.

It’s important to note that while these models possess remarkable capabilities, they are not replacements for human expertise. Instead, they serve as force multipliers, enhancing the analytical capabilities of professionals and enabling them to focus on high-level strategic thinking. The synergy between AI and human expertise presents a unique opportunity for collaboration, where the strengths of each are leveraged to their fullest potential.

In the subsequent sections of this article, we’ll explore how the fusion of AI with financial knowledge is shaping various aspects of decision-making, including risk assessment, customer communication, portfolio management, and algorithmic trading. As Finance Business Analysts and Software Engineers, understanding the intricate dance between AI and financial intelligence will empower you to navigate the dynamic landscape with confidence and innovation.

2. Unleashing the Power of Textual Insights in Finance

In the rapidly evolving landscape of finance, data reigns supreme, and the ability to harness the power of information is a strategic advantage that can’t be overstated. Traditional financial analysis, once rooted in manual data parsing and numerical computations, is undergoing a profound transformation. This transformation is being driven by the unprecedented ability of AI models like FinGPT and LLAMA 2 to unearth the hidden gems concealed within vast oceans of textual data.

The Overwhelming Data Challenge: Drowning in a Sea of Text

Financial professionals have long been accustomed to dealing with staggering volumes of data. Financial reports, market news, earnings call transcripts, regulatory documents, social media chatter — the sources are diverse and seemingly endless. Yet, amidst this wealth of information lies a formidable challenge: making sense of it all in a timely and meaningful way.

Before the advent of AI-powered language models, the process of digesting textual data was a laborious and often incomplete task. Even with the aid of keyword searches and rudimentary sentiment analysis tools, much of the valuable insight tucked away in these texts remained inaccessible. Finance analysts and IT experts grappled with a seemingly insurmountable task: transforming raw data into actionable intelligence.

From Information Overload to Actionable Insights: AI’s Game-Changing Role

Enter FinGPT and LLAMA 2, two remarkable AI models that have democratized access to textual insights in finance. These models have been meticulously trained on a vast corpus of financial documents, market analyses, and economic literature. Their remarkable ability to understand context, discern sentiment, and identify relevant information has propelled them to the forefront of financial decision-making.

With these AI models, the narrative shifts from information overload to actionable insights. Here’s how:

- Customized Reports and Summaries: FinGPT and LLAMA 2 can automatically generate customized reports and summaries tailored to the specific needs of financial professionals. They sift through mountains of data, distilling key findings, trends, and critical information into easily digestible formats. This capability not only saves time but also enhances the quality of decision-making.

- Real-time Updates: Financial markets are in constant flux, reacting to news, events, and economic indicators. Keeping pace with these changes is imperative for making timely decisions. AI models like FinGPT and LLAMA 2 can provide real-time updates by scanning and summarizing the latest news and reports, ensuring that professionals are well-informed and prepared to act swiftly.

- Cross-Referencing and Validation: Beyond summarization, these models have the capacity to cross-reference information from various sources. This cross-referencing can validate data accuracy, detect discrepancies, and offer a more comprehensive view of a given situation. This feature is particularly valuable in an era where misinformation can have profound financial consequences.

Let’s take a peek behind the scenes to understand how FinGPT and LLAMA2 work their magic with data in the financial world.

Imagine you have a massive stack of financial documents — reports, news articles, market data, and more. It’s like having a mountain of puzzle pieces, but no time to assemble them manually.

Now, enter FinGPT and LLAMA2, our AI wizards. They’re super-smart at recognizing patterns and making sense of text. Here’s how they do it:

- Data Ingestion: First, they gobble up all that financial data you provide. It’s like feeding them pieces of the puzzle.

- Text Understanding: Next, these AI models dive deep into the text. They read every word, sentence, and paragraph. It’s like they’re deciphering the puzzle pieces’ colors, shapes, and edges.

- Contextual Analysis: They’re not just reading, though; they’re also figuring out what it all means. They connect the dots between different documents and sources. It’s like piecing together the puzzle to reveal a bigger picture.

- Pattern Recognition: These models are masters at spotting trends and anomalies. They can tell you when something exciting or worrisome is happening in the financial world. It’s like finding that one piece of the puzzle that changes everything.

- Data Output: Finally, they generate useful insights and recommendations. It’s like handing you a beautifully assembled puzzle, showing you the complete financial picture.

So, in simple terms, FinGPT and LLAMA2 are like super-smart puzzle solvers for financial data. They read, understand, and piece together the puzzle for you, so you can make better decisions in the ever-changing world of finance.

In essence, FinGPT and LLAMA 2 are poised to be the trusted companions of finance and IT experts in navigating the treacherous waters of textual data. They have the uncanny ability to sift through the noise, extract valuable nuggets of information, and present them in a manner that empowers professionals to make well-informed decisions.

As we journey deeper into the realm of financial intelligence, we’ll explore specific applications of these AI models in risk assessment, customer communication, portfolio management, algorithmic trading, and more. The implications are profound, and the opportunities for innovation are boundless. Welcome to a future where the power of textual insights in finance is at your fingertips.

3. Navigating Risk and Reward: Applications in Risk Assessment

Risk assessment is the bedrock of prudent financial decision-making. In the world of finance, where fortunes can be made or lost in an instant, the ability to assess and manage risks is paramount. FinGPT and LLAMA 2, the AI powerhouses we’ve been exploring, are not merely tools for information extraction; they are instrumental in navigating the complex terrain of financial risk.

Analyzing Historical Data for Risk Patterns: Beyond the Numbers

Traditionally, risk assessment has relied heavily on numerical data such as price movements, volatility, and financial ratios. While these quantitative metrics remain essential, they often fall short in capturing the full spectrum of risks inherent in financial markets. This is where AI-driven textual analysis comes into play.

FinGPT and LLAMA 2 are equipped to ingest vast quantities of historical data, including news articles, earnings reports, regulatory filings, and market commentaries. What sets them apart is their ability to interpret the narratives embedded within this data. They can identify not only the events themselves but also the context, sentiment, and potential impacts on various financial instruments.

For instance, consider the aftermath of a central bank’s unexpected interest rate decision. Beyond the immediate market reactions, these AI models can delve into textual data to uncover how market participants, analysts, and institutions perceive and interpret the central bank’s actions. This nuanced understanding of sentiment can be a key factor in predicting future market movements.

AI-Powered Risk Assessment Models: From Reactive to Proactive

AI models like FinGPT and LLAMA 2 are not just retrospective tools; they are forward-looking risk assessment companions. Their ability to process real-time information enables the development of dynamic risk models that adapt to changing market conditions.

Here’s how it works:

- Real-time Sentiment Analysis: These models can continuously monitor news feeds, social media platforms, and financial reports to gauge market sentiment. Sentiment analysis, when combined with quantitative data, provides a more comprehensive risk assessment. For instance, a sudden surge in negative sentiment towards a particular industry may signal heightened risks.

- Event Detection: Beyond sentiment, AI models can detect and categorize financial events as they occur. Whether it’s a geopolitical event, earnings announcement, or regulatory change, FinGPT and LLAMA 2 can swiftly identify and assess the potential impact of these events on portfolios.

- Scenario Analysis: These AI models enable financial experts to run scenario analyses in real-time. By inputting various hypothetical events and market conditions, professionals can gauge the potential impact on portfolios and strategies, allowing for more proactive risk management.

FinGPT and LLAMA 2 can be instrumental in risk assessment within the financial industry. Here are three real-world applications:

Credit Risk Assessment:

Banks and lending institutions use AI models like FinGPT and LLAMA 2 to assess the credit risk of potential borrowers. These models analyze a wide range of data, including credit reports, financial statements, transaction histories, and economic indicators. By processing this information, they can predict the likelihood of a borrower defaulting on a loan. This enables lenders to make more informed lending decisions, set appropriate interest rates, and manage their credit portfolios more effectively. The result is reduced credit risk and more responsible lending practices.

Market Risk Analysis:

In the world of investment and portfolio management, understanding market risk is crucial. FinGPT and LLAMA 2 can analyze vast amounts of textual data, including news articles, earnings reports, and social media posts, to gauge market sentiment and assess potential risks. For instance, they can detect a surge in negative sentiment related to a particular industry or asset class, signaling a potential market downturn. This real-time analysis allows risk managers and portfolio managers to adjust strategies and portfolios to mitigate potential losses. It provides an additional layer of risk assessment beyond traditional quantitative models.

Operational Risk Management:

Operational risks encompass a wide range of factors, including internal processes, human errors, and external events. FinGPT and LLAMA 2 can assist in operational risk management by analyzing incident reports, regulatory documents, and internal communications. For example, if these models detect an increase in the frequency of internal incident reports related to a specific process or department, it could indicate an emerging operational risk. Risk managers can then investigate and take preventive measures to address the issue before it escalates. This proactive approach enhances operational risk management and safeguards the institution’s reputation and financial stability.

Dynamic Risk Scenarios and Mitigation Strategies: A Paradigm Shift

The traditional approach to risk assessment often involves periodic reviews and adjustments. However, the dynamic nature of today’s financial markets demands a more nimble approach. With the assistance of AI models, risk assessment becomes an ongoing, real-time process.

Financial experts can not only identify risks as they emerge but also develop mitigation strategies in response. For example, if a text analysis indicates that a portfolio may be exposed to certain geopolitical risks, adjustments can be made swiftly to hedge against potential losses.

FinGPT and LLAMA 2 are not just tools for processing data; they represent a fundamental shift in the way we understand and manage risk in finance. By harnessing the power of textual insights and integrating them with quantitative data, finance and IT experts can navigate the complexities of financial risk assessment with a precision and timeliness that was previously unattainable. As we explore further applications in this dynamic field, the potential for innovation and improved risk management becomes abundantly clear. Stay tuned for more insights into the transformative role of AI in finance.

4. Capitalizing on Sentiment: AI in Customer Communication

In the world of finance, effective customer communication isn’t just about delivering information; it’s about building trust and confidence in a highly competitive landscape. AI models like FinGPT and LLAMA 2 are proving to be invaluable assets in enhancing customer interactions by leveraging the power of sentiment analysis and personalized communication.

Enhancing Customer Interactions: The Age of Personalization

Traditionally, financial institutions have communicated with their clients through generic emails and reports, often lacking the personal touch that fosters strong relationships. However, the modern customer demands a personalized experience, one that speaks directly to their unique financial needs and concerns. This is where AI-driven communication steps in.

FinGPT and LLAMA 2 excel at understanding and generating human-like text. They can analyze customer profiles, transaction histories, and financial goals to craft personalized messages and recommendations. For instance, when sending out financial reports, these models can accompany the report with a tailored summary that highlights key information most relevant to the individual client’s portfolio.

Moreover, in the age of robo-advisors and online financial platforms, these AI models can serve as virtual financial advisors, engaging in dynamic conversations with clients to address inquiries, offer investment insights, and provide real-time updates.

Personalized and Contextual Communication: Building Trust and Confidence

The true power of AI in customer communication lies in its ability to understand context and sentiment. Sentiment analysis is a game-changer in gauging customer satisfaction and identifying potential issues before they escalate.

For instance, if a client expresses concerns or dissatisfaction through an email or chat message, AI models can immediately detect these sentiments. Rather than sending automated responses, they can initiate a personalized conversation to address the concerns, offer solutions, and reassure the client. This proactive approach not only resolves issues promptly but also strengthens client relationships by demonstrating a genuine commitment to their financial well-being.

The Role of Sentiment Analysis: Predictive Insights and Risk Mitigation

Beyond client interactions, sentiment analysis holds substantial predictive power in financial services. AI models can analyze market sentiment across various sources, including news articles, social media, and analyst reports. By tracking sentiment trends, financial experts can gain insights into potential market shifts and emerging risks.

For instance, a surge in negative sentiment towards a specific industry may signal potential market downturns or regulatory challenges. Armed with this knowledge, finance and IT experts can proactively adjust investment strategies, mitigate risks, and position portfolios for resilience.

Compliance and Ethics: The Balancing Act

While AI in customer communication offers immense benefits, it also raises ethical and compliance considerations. Financial institutions must ensure that AI-generated communications adhere to regulatory standards and are transparent about their AI-driven nature. Striking the right balance between AI-driven efficiency and ethical communication is an ongoing challenge that requires careful oversight.

The integration of AI models like FinGPT and LLAMA 2 into customer communication processes marks a profound shift in the financial industry. It empowers finance and IT experts to provide personalized, context-aware, and proactive services that not only enhance customer satisfaction but also enable predictive insights and risk mitigation. As these technologies continue to evolve, striking the balance between automation and ethical communication will be crucial in building trust and confidence in the digital age of finance. Stay tuned for more insights into the transformative role of AI in finance.

5. The Intelligent Portfolio Manager: Portfolio Management with AI

Portfolio management, a core function in the world of finance, involves a delicate balancing act between maximizing returns and minimizing risks. It’s a terrain where decisions can have profound implications for investors and institutions alike. The infusion of AI models like FinGPT and LLAMA 2 into portfolio management is ushering in a new era of data-driven, intelligent decision-making.

Real-time Portfolio Analysis: Beyond Spreadsheets and Charts

Historically, portfolio management heavily relied on spreadsheets, charts, and quantitative analysis tools. While these tools are valuable for assessing historical performance and asset allocation, they often fall short in providing real-time insights and adapting to rapidly changing market conditions.

AI models like FinGPT and LLAMA 2, with their natural language understanding capabilities, excel in real-time analysis of textual data. They can monitor market news, earnings reports, economic indicators, and regulatory changes as they happen. This real-time monitoring allows portfolio managers to stay abreast of unfolding events that could impact their portfolios.

Predictive Portfolio Adjustments: Anticipating Market Shifts

One of the most profound advantages of AI in portfolio management is its predictive capability. By analyzing textual data for sentiment, trend analysis, and market news, these models can forecast potential market shifts and assess their implications on portfolios.

For example, if sentiment analysis reveals a growing negative sentiment toward a particular industry, it could signal a potential downturn. AI can proactively recommend portfolio adjustments, such as reducing exposure to that industry or reallocating assets to mitigate risks.

Balancing Diversification and Returns: The AI Edge

Diversification is a fundamental principle in portfolio management, aimed at spreading risk across various assets to reduce the impact of individual asset underperformance. However, achieving the right balance between diversification and returns can be challenging.

AI models excel in this regard by analyzing a vast array of data sources to identify opportunities for diversification without sacrificing returns. They can detect correlations and patterns that might not be immediately apparent to human analysts, enabling portfolio managers to make more informed asset allocation decisions.

Risk Management and Stress Testing: Preparing for the Unexpected

Risk management is a critical aspect of portfolio management, and AI models are powerful tools for assessing and mitigating risks. These models can perform stress tests on portfolios by simulating various adverse scenarios, such as market crashes or economic downturns.

By analyzing historical data and market news, AI can assess how portfolios might perform under stress and recommend adjustments to enhance resilience. This forward-looking risk assessment is a valuable addition to traditional risk management practices.

The Human-AI Partnership: Augmenting Expertise

It’s important to note that AI models like FinGPT and LLAMA 2 are not replacements for human expertise; they are partners in decision-making. Portfolio managers bring domain knowledge and experience to the table, while AI complements their capabilities by providing data-driven insights and real-time analysis.

In this dynamic partnership, portfolio managers can leverage AI to streamline decision-making processes, enhance risk management, and gain a competitive edge in today’s fast-paced financial markets. The fusion of human expertise with AI-driven intelligence represents the future of portfolio management, where the art and science of finance converge to deliver optimal results.

3 compelling examples that demonstrate the benefits of using FinGPT and LLAMA 2 in portfolio management

1- Real-time Sentiment Analysis for Stock Picking:

In the world of portfolio management, staying ahead of market sentiment is crucial. FinGPT and LLAMA 2 can continuously analyze a wide range of textual sources, including financial news, social media, and earnings reports. Let’s say a portfolio manager is considering adding a tech stock to their portfolio. By leveraging these AI models, they can assess the real-time sentiment surrounding the company in question. If they detect a surge in positive sentiment due to a product launch, strategic acquisition, or earnings beat, the manager may decide to invest. Conversely, if negative sentiment starts to rise, signaling potential issues, they can reconsider. This real-time sentiment analysis enhances stock selection by incorporating a dynamic, data-driven approach into the decision-making process.

2- Risk Mitigation through Regulatory Insight:

Regulatory changes can have a profound impact on portfolios, especially in highly regulated industries like finance and healthcare. Traditional portfolio managers often rely on periodic reviews and legal counsel to navigate these changes. FinGPT and LLAMA 2, however, can be used to scan and interpret regulatory updates and documents in real time. For instance, if there’s a change in financial reporting requirements for a particular sector, AI models can promptly identify and analyze the implications for portfolios. Portfolio managers can then adjust their holdings or strategies accordingly to mitigate potential risks. This proactive approach to regulatory insights can prevent compliance issues, protect investments, and ensure portfolios remain aligned with changing legal landscapes.

3- Dynamic Asset Allocation with Macro-Economic Insights:

Economic indicators and macro-economic trends play a pivotal role in asset allocation. By processing economic reports, central bank announcements, and expert analyses, FinGPT and LLAMA 2 can offer insights into the broader economic landscape. For instance, these models can identify signs of inflationary pressures, changes in interest rates, or shifts in fiscal policies. Armed with these insights, portfolio managers can adjust asset allocations to capitalize on potential opportunities or shield portfolios from emerging risks. This dynamic asset allocation strategy allows for a more responsive and proactive approach to managing portfolios in an ever-changing economic environment.

In all these examples, the integration of FinGPT and LLAMA 2 into portfolio management processes enhances decision-making by providing real-time insights, predictive capabilities, and a broader range of data sources. This, in turn, can lead to improved portfolio performance, better risk management, and a competitive edge in the financial markets.

As we explore further applications of AI in finance, we’ll uncover how these technologies are reshaping algorithmic trading, optimizing investment strategies, and more. The potential for innovation and improved financial outcomes is limitless, making this an exciting era for finance and IT experts. Stay tuned for more insights into the transformative role of AI in finance.

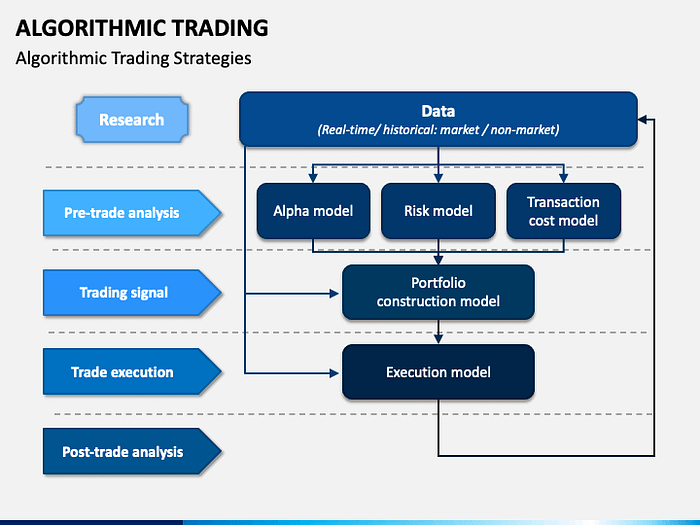

6. Algorithmic Trading Redefined: AI in Financial Markets

Algorithmic trading, a cornerstone of modern financial markets, hinges on the ability to swiftly analyze vast datasets and execute trades with precision. With the advent of AI, particularly machine learning, algorithmic trading is undergoing a profound transformation. This section explores the evolving landscape of algorithmic trading, the integration of machine learning, and the role of AI models like FinGPT and LLAMA 2 in algorithmic decision-making.

Algorithmic Trading Landscape: Speed, Data, and Complexity

Algorithmic trading, often referred to as algo trading or black-box trading, involves the use of computer programs to execute a large number of orders at exceptional speeds. These algorithms rely on predefined rules and parameters to make trading decisions, typically based on quantitative analysis of historical data.

The goal of algorithmic trading is twofold: to execute trades swiftly, capitalizing on price differentials and market inefficiencies, and to manage risk effectively by automating trading strategies. In today’s hyper-connected, high-frequency trading environment, algo trading is ubiquitous, accounting for a significant portion of trading volume.

Machine Learning in Algorithmic Trading: Beyond Rules-Based Strategies

While traditional algorithmic trading strategies are rule-based, machine learning introduces an entirely new dimension to the field. Machine learning algorithms, powered by AI models, can adapt and evolve based on incoming data. They have the capacity to identify complex patterns, correlations, and anomalies that may be beyond the scope of traditional algorithms.

Key areas where machine learning is transforming algorithmic trading include:

- Pattern Recognition: Machine learning algorithms can recognize intricate patterns in historical price data, trading volumes, and market behavior. They use these patterns to predict future price movements and execute trades accordingly.

- Sentiment Analysis: AI models can analyze vast amounts of textual data, such as news articles and social media posts, to gauge market sentiment. Sentiment analysis is particularly valuable in predicting short-term market movements and reacting to breaking news.

- Portfolio Optimization: Machine learning can optimize portfolio construction by considering factors such as risk tolerance, return objectives, and market conditions. These algorithms continuously adjust portfolio weights to maximize returns while managing risk.

The Role of FinGPT and LLAMA 2 in Algorithmic Decision-Making

FinGPT and LLAMA 2, with their natural language understanding capabilities, bring a unique perspective to algorithmic trading. While not typically used for executing trades directly, they play a crucial role in enhancing trading strategies in several ways:

- News and Event Analysis: These AI models can scan news articles, earnings reports, and economic indicators, extracting relevant information that can inform trading decisions. For example, they can identify earnings surprises, regulatory changes, or geopolitical events that might impact asset prices.

- Sentiment-Driven Trading: By analyzing sentiment in textual data, AI models can provide real-time insights into market sentiment. If, for instance, there is a sudden surge in negative sentiment toward a particular asset, algorithmic trading strategies can adapt to respond to potential price movements.

- Risk Management: AI models can contribute to risk management in algorithmic trading by providing early warnings of market shifts or unforeseen risks. This proactive risk assessment allows trading algorithms to make adjustments to minimize potential losses.

- Dynamic Strategy Adaptation: AI can continuously analyze data to optimize trading strategies in real-time. As market conditions change, algorithmic trading strategies can adapt to capitalize on emerging opportunities or mitigate risks.

Algorithmic trading is no longer confined to rigid rules; it’s evolving into a dynamic, adaptive field powered by AI and machine learning. The integration of AI models like FinGPT and LLAMA 2 into algorithmic decision-making processes is redefining how trading strategies are developed and executed.

For finance and IT experts, this presents both opportunities and challenges. The opportunities lie in harnessing the power of AI to enhance trading strategies, improve risk management, and capitalize on market dynamics. However, challenges include ensuring the ethical use of AI, managing the complexity of machine learning algorithms, and staying ahead in an ever-competitive trading landscape.

3 compelling examples that illustrate the benefits of using FinGPT and LLAMA 2 in algorithmic trading

1- News-Based Sentiment Analysis for Trade Execution:

In algorithmic trading, executing trades at the right moment is critical for optimizing returns. FinGPT and LLAMA 2 can be employed to analyze real-time news feeds, financial reports, and social media updates. Let’s say an algorithmic trading system is designed to trade on the stock of a particular company. These AI models can continuously monitor news sources for mentions of that company, assess sentiment (positive or negative) in the articles, and gauge the potential impact on the stock’s price. If a sudden surge in negative sentiment is detected due to adverse news, the algorithm can trigger a sell order to mitigate potential losses. Conversely, if positive news emerges, the algorithm can initiate a buy order. This real-time sentiment analysis enhances trade execution by incorporating dynamic information into the decision-making process.

2- Predictive Analytics for Risk Management:

Risk management is a cornerstone of algorithmic trading. Predicting potential market shifts or anomalies is essential for minimizing losses. FinGPT and LLAMA 2 can assist in this by analyzing historical data, market news, and economic indicators to identify patterns that might precede market changes. For instance, these AI models can detect subtle correlations between certain economic indicators and stock price movements. If such a correlation indicates a potential market downturn, the algorithmic trading system can proactively adjust its trading strategies. This predictive risk assessment helps algorithmic traders navigate volatile markets with greater confidence and resilience.

3- Behavioral Finance Insights for Strategy Optimization:

Behavioral finance plays a significant role in market dynamics. Investors’ emotions and behavioral biases can influence asset prices. FinGPT and LLAMA 2 can analyze financial news articles and social media posts to gauge market sentiment and investor behavior. For example, if a specific stock experiences a surge in positive sentiment on social media platforms, it might indicate a growing retail investor interest. Algorithmic trading models can leverage this information to optimize their strategies. They can adapt to capitalize on momentum or contrarian trading strategies, depending on the sentiment and behavior detected. This ability to incorporate behavioral finance insights into algorithms allows for more agile and adaptive trading strategies.

In these examples, the integration of FinGPT and LLAMA 2 into algorithmic trading systems enhances decision-making by providing real-time sentiment analysis, predictive risk assessment, and behavioral finance insights. These models offer a data-driven edge in navigating financial markets, leading to potentially improved trading performance and risk management.

As we explore further applications of AI in finance, including ethical considerations and the fine line between human expertise and AI, we’ll continue to uncover the transformative potential of these technologies in the financial world. Stay tuned for more insights into the dynamic intersection of finance and AI.

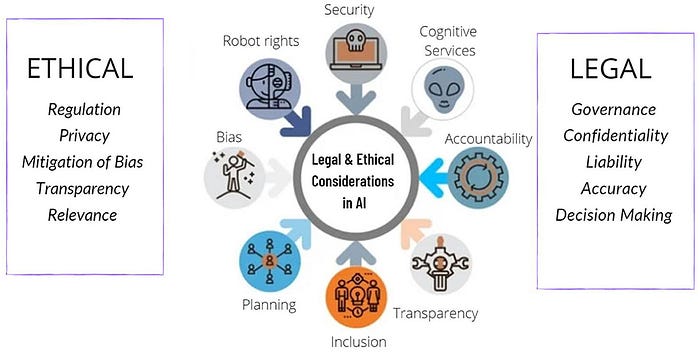

7. Beyond the Numbers: Ethical Considerations in AI Finance

The integration of artificial intelligence, particularly in the realm of finance, brings forth not only innovative possibilities but also profound ethical considerations. As finance and IT experts, it’s imperative that we delve into the ethical dimensions of AI in finance, exploring topics such as bias mitigation, transparency, accountability, and the delicate balance between AI and human expertise.

Bias Mitigation and Fairness: Striving for Equity in Financial AI

One of the foremost ethical challenges in AI finance is addressing bias and ensuring fairness. Machine learning models, including those used in algorithmic trading and risk assessment, learn from historical data, which can be tainted by biases present in society and past practices.

Bias in AI can lead to unfair outcomes, reinforcing systemic inequalities. For example, if a machine learning model is trained on historical lending data that discriminates against certain demographic groups, it can perpetuate those biases in credit decisions.

To mitigate bias and enhance fairness in AI finance:

- Diverse Training Data: Ensuring that training data is representative and diverse is critical. It should accurately reflect the demographics and characteristics of the population it serves.

- Regular Audits: Periodic audits of AI models can help identify and rectify biases. AI systems should be transparent and open to scrutiny.

- Explainable AI: Employing explainable AI models allows us to understand the decision-making process of AI algorithms, making it easier to pinpoint and address bias.

Transparency and Accountability: Demanding Clarity in Financial AI

Transparency is paramount in ensuring accountability for AI-driven financial decisions. Transparency means that AI processes are understandable, and the reasons behind specific recommendations or decisions are clear. In the finance sector, transparency can be challenging due to the complexity of AI models.

To enhance transparency and accountability:

- Model Documentation: Comprehensive documentation of AI models, including their training data, parameters, and decision-making processes, is crucial.

- Regulatory Compliance: Adherence to financial regulations that require transparency and accountability is essential. Compliance ensures that AI models meet legal standards.

- Ethics Committees: Establishing ethics committees within financial institutions can provide oversight and ensure that AI-driven decisions align with ethical standards.

Striking the Balance Between AI and Human Expertise: The Human-AI Partnership

AI in finance should be seen as a complement to human expertise rather than a replacement. Striking the right balance between AI and human involvement is essential for ethical and effective decision-making.

- Human Oversight: Human experts should oversee AI models, especially in critical financial decisions. They should have the authority to override AI recommendations when necessary.

- Continuous Training: Financial professionals need ongoing training to understand AI systems, their limitations, and how to interpret their outputs.

- Ethical Training: Training programs should include ethical considerations to ensure that finance experts are aware of the potential biases and ethical dilemmas AI can introduce.

As we navigate the exciting terrain of AI in finance, we must prioritize ethical considerations. The financial industry has a responsibility to ensure that AI is used responsibly, fairly, and transparently.

Our commitment to bias mitigation, transparency, and a harmonious human-AI partnership will not only enhance the ethical standing of AI in finance but also build trust with clients, regulators, and the public. By addressing these ethical challenges head-on, we can unlock the full potential of AI in finance while safeguarding the integrity of the industry. As finance and IT experts, it’s our collective responsibility to shape the ethical foundations for the future of finance.

Conclusion

The transformative power of FinGPT and LLAMA 2 in the financial industry cannot be overstated. These AI models, with their natural language understanding capabilities and financial domain expertise, are reshaping the way financial institutions operate. From automating report generation to real-time sentiment analysis for trading decisions, from risk assessment to enhancing customer support, FinGPT and LLAMA 2 are becoming indispensable tools for finance professionals. However, as we embrace this new era of AI-driven financial intelligence, it’s crucial to strike a balance between innovation and ethics. Ensuring transparency, addressing bias, and maintaining human oversight are key to responsible AI adoption. As finance and IT experts, we are at the forefront of this transformative journey, and it’s our collective responsibility to harness the potential of FinGPT and LLAMA 2 while upholding the ethical standards that underpin the financial industry. With this approach, we can unlock new possibilities, improve decision-making, and navigate the ever-evolving landscape of finance with confidence and integrity.