The financial world is undergoing a revolution (AI Revolution). Digital banking, once considered a cutting-edge leap in the way we manage our finances, is now fast becoming an outdated concept. While it provided customers with 24/7 access and a self-service model, it is increasingly being overshadowed by the rise of the intelligent bank. The question is no longer “if” banks will transition to intelligent systems, but “when,” and how quickly they can adapt to this shift.

As we look ahead, it’s clear that the evolution of banking from digital to intelligent is a matter of urgency. So, what does it mean to move from a digital bank to an AI-driven intelligent bank? Let’s break down the key elements of this transition and explore how banks can leverage artificial intelligence (AI) to provide enhanced services, improve operational efficiency, and drive innovation.

1. From Transactional to Predictive Banking

Digital banking allowed customers to conduct basic transactions like checking account balances, transferring funds, and paying bills at any time of day or night. But intelligent banking takes things a step further by shifting from transactional banking to predictive banking. Rather than just reacting to customer actions, AI-driven models can predict customer needs and offer personalized financial services before they even ask.

By analyzing real-time data, AI can identify patterns and trends in a customer’s behavior, enabling the bank to offer proactive solutions. This includes personalized financial insights, automated investment recommendations, and even proactive credit offerings. For example, AI can alert a customer to potential savings opportunities, flag upcoming payments, or suggest loan options based on their unique financial situation.

This shift is about anticipating needs, rather than simply responding to requests, which enhances the customer experience and opens up new avenues for product offerings.

2. AI-Powered Risk & Fraud Management

Risk management and fraud detection are critical elements of banking, and traditional digital banking systems often relied heavily on historical data to assess risks. While this approach had some success, it was reactive and couldn’t predict future threats with accuracy.

Intelligent banks use AI and machine learning to detect fraud in real time, identify suspicious patterns, and prevent threats before they occur. By constantly analyzing transaction data, AI can spot anomalies and flag potentially fraudulent activity much faster than human oversight alone. This allows banks to take action immediately and mitigate potential losses.

Additionally, AI-driven risk models enable banks to evaluate credit risk more effectively, helping to improve lending decisions and reduce defaults. By using AI to analyze a wide array of data points (including social behavior, spending habits, and even external market trends), banks can make more accurate assessments of risk, enhancing their ability to make smarter financial decisions.

3. Hyper-Personalization

In the past, digital banking often involved offering customers generic financial products that were designed for a wide audience. However, this approach is rapidly becoming outdated in an age where customers expect more tailored services. Intelligent banking introduces the concept of hyper-personalization, where financial products are custom-fitted to the unique needs of individual customers.

By utilizing AI, banks can offer personalized services like custom loan terms, investment opportunities, or even financial planning tools tailored to a customer’s specific goals and financial situation. Rather than bombarding customers with irrelevant advertisements or promotions, intelligent banks provide them with targeted offerings that align with their needs. This approach can lead to higher customer satisfaction and greater customer loyalty.

Mass personalization also benefits banks by driving cross-selling and upselling opportunities. For example, if an AI system detects that a customer is reaching a specific financial milestone, it could automatically offer relevant products like a home loan or retirement planning services.

4. Seamless Omni-Channel Experience

The digital banking experience typically took place across a few key touchpoints, such as websites, mobile apps, or ATMs. However, customers today don’t want to interact with their bank on just one platform. They expect to be able to start a transaction on their mobile app, continue it via a chatbot, and complete it with a human advisor, all while maintaining a seamless, connected experience.

Intelligent banking ensures that customer interactions flow smoothly across multiple channels, eliminating friction and improving convenience. AI plays a crucial role in this process by enabling automated systems that understand context, recognize customer preferences, and provide a personalized experience regardless of the channel. This allows customers to interact with their bank in whichever way is most convenient for them without having to repeat themselves or face disconnected experiences.

The result is a banking experience that is faster, more flexible, and increasingly intuitive, meeting the needs of the modern consumer who expects seamless integration across all digital touchpoints.

5. Autonomous Banking Operations

Behind the scenes, intelligent banks are also transforming their operations. Traditional banking systems often involved manual processes, which were not only time-consuming but also prone to human error. However, intelligent banks are now optimizing their back-office operations through automation powered by AI and cloud technology.

Tasks such as loan approvals, compliance checks, and reconciliation can now be managed by AI-driven workflows. These systems use machine learning to constantly improve and adapt, ensuring that processes run smoothly without the need for human intervention. This significantly reduces operational costs, increases efficiency, and helps banks scale their services without compromising on quality.

The ability to automate complex processes also allows banks to focus on innovation and deliver more value to their customers. It reduces the burden on human employees, allowing them to focus on higher-value tasks, such as relationship-building and strategic decision-making.

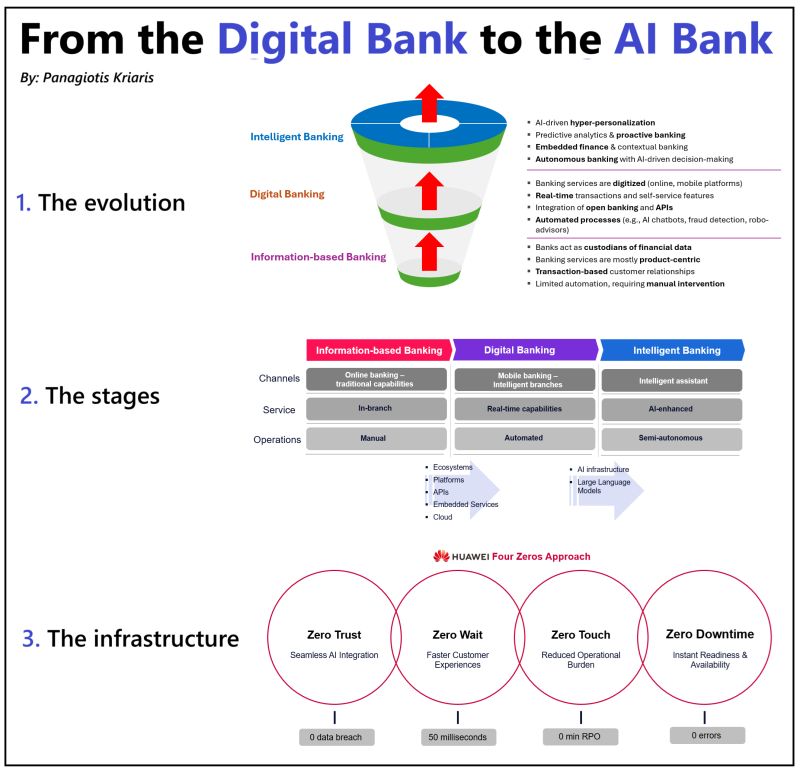

Supporting the Transition: Huawei’s 4-Zero Model

For banks looking to make the leap from digital to intelligent, technology is the key enabler. One interesting approach comes from Huawei’s 4-Zero model, which offers a roadmap for banks to transition smoothly to AI-powered operations. The 4-Zero model focuses on four key pillars:

- Zero Downtime → Instant Readiness: Predictive maintenance and cloud resilience ensure 24/7 availability, minimizing disruptions to banking services and ensuring that AI solutions can be deployed without service interruptions.

- Zero Wait → Faster Customer Experiences: AI-driven real-time processing eliminates delays in transactions, approvals, and customer interactions, making banking services ultra-responsive and customer-centric.

- Zero Touch → Reduced Operational Burden: End-to-end automation using AI reduces the need for manual intervention in key processes like KYC, loan approvals, and compliance, allowing banks to focus more on innovation and customer service.

- Zero Trust → Seamless AI Integration: AI-driven security frameworks continuously validate access and ensure compliance, allowing banks to safely integrate AI-powered services without increasing risk.

Conclusion: The Era of Intelligent Banking Is Now

The transition from digital to intelligent banking is already underway, and those who hesitate may find themselves left behind. While the move from a digital bank to an AI bank may seem daunting, the benefits are clear: enhanced customer experiences, smarter decision-making, and more efficient operations.

Banks that embrace AI now, rather than waiting for the future, will be better positioned to compete in a rapidly changing market. By focusing on AI-driven personalization, improved risk management, and autonomous operations, banks can future-proof themselves and thrive in an increasingly tech-driven world. The era of intelligent banking isn’t a distant future—it’s happening right now, and the race is on to get ahead of the curve.