Following the launch of Chat GPT, GenAI has captured all the focus, making us often forget its traditional sibling. Let’s take a look at how they compare and differ using financial services’ use cases. Artificial intelligence existed long before GenAI. Known under the term Predictive AI, it is all about predicting outcomes, future developments, and forecasting trends.

Understanding Predictive AI

Predictive AI, also known as predictive analytics, is a subset of AI technology that focuses on using historical data and machine learning algorithms to analyze patterns and make predictions about future events or trends. This type of AI technology aims to help companies and individuals make informed decisions by forecasting likely outcomes based on available data.

How Predictive AI Models Work

Predictive AI is focused on training machine learning algorithms on historical data to identify patterns, relationships, and trends. These models use the insights gained from the training data to make predictions about future occurrences.

Examples of Predictive AI Applications:

- Forecasting Stock Market Trends: Predictive AI is extensively used in the finance industry to analyze historical market data, trends, and indicators. By applying machine learning algorithms to past stock market data, predictive AI models can make forecasts about future stock prices and market trends.

- Predicting Customer Behavior: In the realm of marketing, predictive AI plays a crucial role in analyzing customer data to predict their future behaviors. By examining past interactions, purchase history, and browsing patterns, predictive AI models can anticipate customer preferences and trends.

Understanding Generative AI

Generative AI refers to a type of artificial intelligence that involves training models to create original content. These models learn patterns from existing data and generate new data based on those patterns. In the context of images, text, or even music, generative AI tools produce outputs that are not directly copied from the training data but rather are unique creations inspired by the patterns it has learned.

How Generative AI Models Work

Generative AI models, such as Generative Adversarial Networks (GANs) and autoregressive models, work by learning the statistical patterns present in a dataset. GANs consist of a generator and a discriminator that compete against each other to create authentic-looking content. Autoregressive models generate content step by step, conditioning each step on the previous ones.

Examples of Generative AI Applications:

- Generating Realistic Images and Videos: Generative AI can be used to produce highly realistic images and videos. By learning patterns from a dataset of images, generative models like GANs can create new visuals that closely resemble actual photographs.

- Creating Realistic Speech and Text: Generative AI is also adept at generating human-like speech and text. Language models, such as OpenAI’s GPT-3, can create coherent and contextually relevant paragraphs of text that appear to be written by humans.

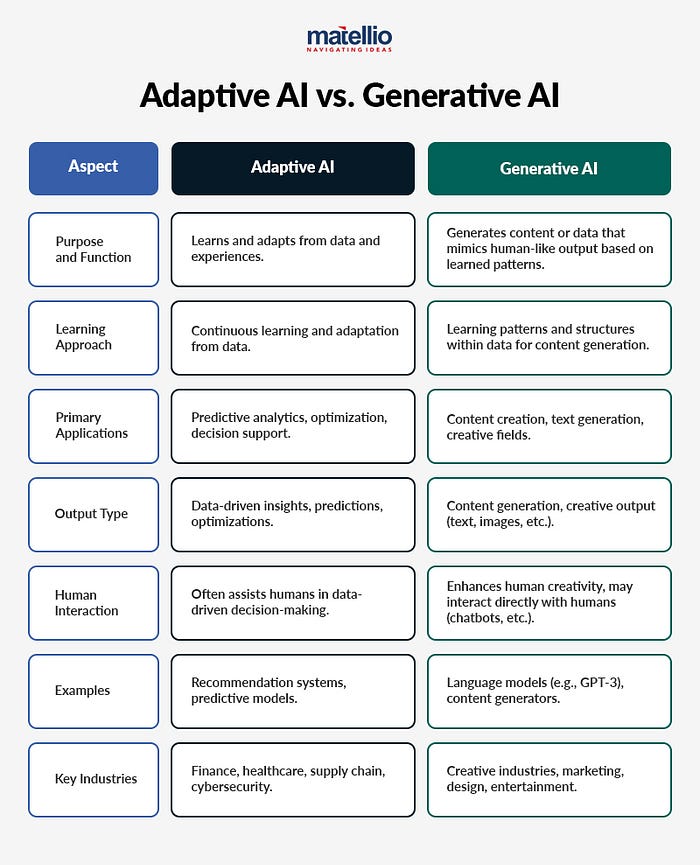

Comparative Analysis

While predictive AI and generative AI serve distinct purposes, their comparative strengths and limitations merit consideration for financial institutions:

- Data Requirements: Predictive AI relies on historical data for training, while generative AI may require less data but necessitates high-quality inputs.

- Use Cases: Predictive AI is advanced in financial services, particularly in risk management and fraud detection, while generative AI shows promise in personalized recommendations and customer interaction.

- Challenges: Despite impressive pilot use cases, challenges such as data availability, integration into existing IT systems, business model adjustment, and workforce upskilling need to be addressed for the widespread adoption of AI in financial services.

Conclusion

The use of predictive AI in financial services is well-established, and its combination with generative AI holds promise for driving innovation and enhancing customer experiences. However, addressing challenges such as data availability, integration, and workforce upskilling is crucial for realizing the full potential of AI in transforming the financial sector.

Call to Action:

What are your thoughts on the future of predictive AI and generative AI in financial services? Share your insights and experiences in the comments section below and join the conversation!